Nigeria has become the third largest debtor to the World Bank’s International Development Association (IDA) as of June 30, 2024, marking a significant increase in the country’s borrowing from the institution.

This development has reflected substantial shift in Nigeria’s financial landscape under the administration of President Bola Tinubu.

According to the World Bank’s latest financial statements, Nigeria’s exposure to the IDA has surged by 14.4%, rising from $14.3 billion in the fiscal year (FY) 2023 to $16.5 billion in FY2024.

This $2.2 billion increase in borrowing has propelled Nigeria into the top three IDA debtors for the first time, moving up from its previous position as the fourth-largest borrower in 2023.

The fiscal year 2024 spans from July 2023 to June 2024, during which Nigeria received at least $2.2 billion from the World Bank.

This period aligns with President Tinubu’s administration, underscoring the growing reliance on international financial support amid domestic economic challenges.

Notably, this debt pertains exclusively to the IDA and is separate from any outstanding loans Nigeria has with the World Bank’s International Bank for Reconstruction and Development (IBRD).

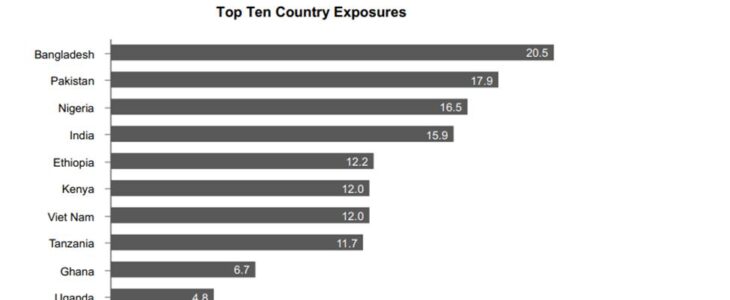

In comparison to other top IDA debtors, Bangladesh retains its position as the largest borrower, with its exposure increasing from $19.3 billion in 2023 to $20.5 billion in 2024.

Pakistan follows on the second position with a stable exposure of $17.9 billion over the same period. Meanwhile, India, previously the third-largest borrower with $17.9 billion in 2023, saw its IDA exposure decrease to $15.9 billion in 2024, allowing Nigeria to surpass it.

Other notable IDA borrowers include Ethiopia, whose exposure grew from $11.6 billion in 2023 to $12.2 billion in 2024.

Kenya and Vietnam both hold exposures of $12.0 billion. Alongside Tanzania, Ghana, and Uganda, these countries round out the top ten IDA debtors, collectively accounting for 63% of the IDA’s total exposure as of June 30, 2024.

The IDA, a crucial arm of the World Bank, focuses on providing concessional loans and grants to the world’s poorest countries. These loans feature low interest rates and extended repayment periods, aiming to foster economic growth, reduce inequalities, and improve living conditions in developing regions.

According to reports, Nigeria secured a total of $4.95 billion in loans from the World Bank under Tinubu’s administration, amid growing concerns over the country’s escalating external debt servicing costs.

However, only about 16% of these new loans have been received so far. The World Bank may approve an additional four loan projects for Nigeria this year, potentially totaling $2 billion.

Furthermore, data from the external debt stock report of the Debt Management Office (DMO) indicates that Nigeria’s total debt to the World Bank stood at $15.59 billion as of March 31, 2024.

Credit: Leadership